Price Action Series Chapter 3: Plot Support/Resistance

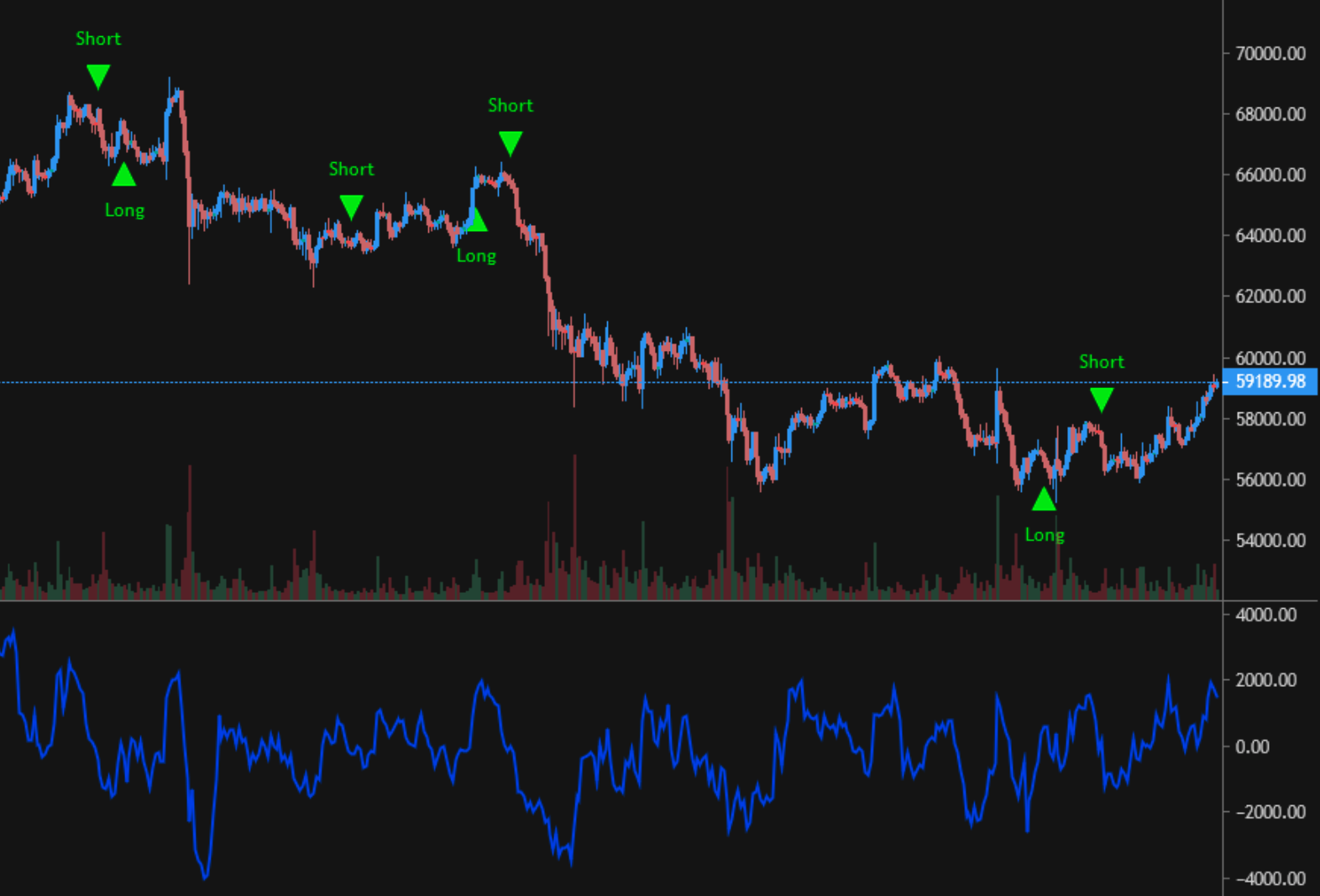

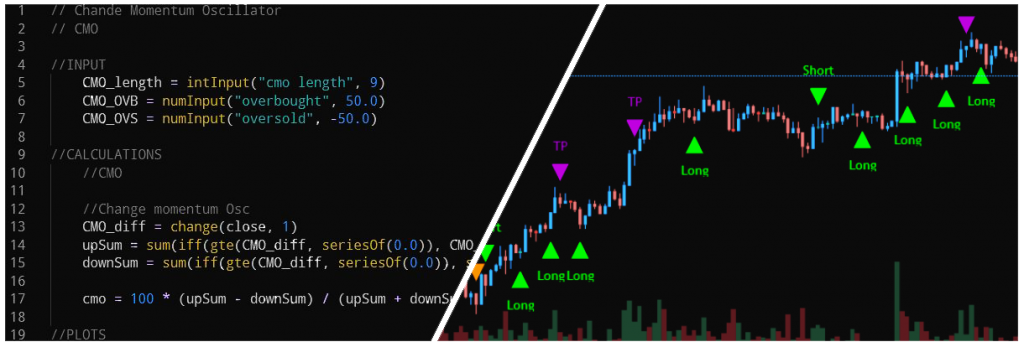

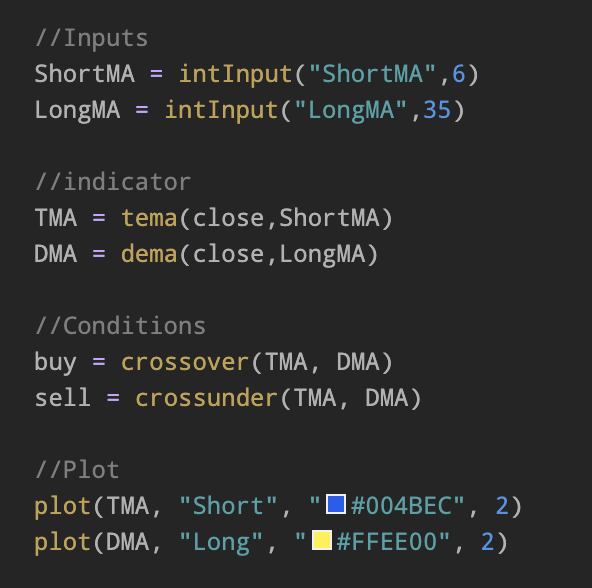

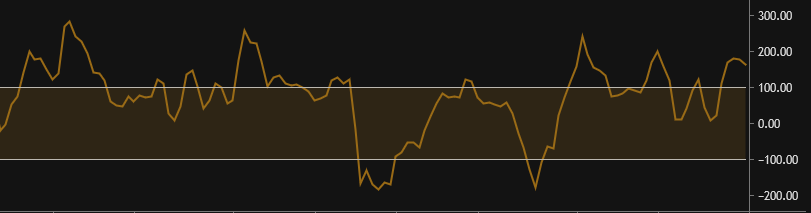

In this chapter, we dive right into the rules for drawing support and resistance zones. We define a zone by taking into account: Swing highs and swing lows, meaning the highest and lowest points price reaches in a time period; Multiple touches and bounces off an area, the more the better; If the area you’re…