Tag: Technical Indicator

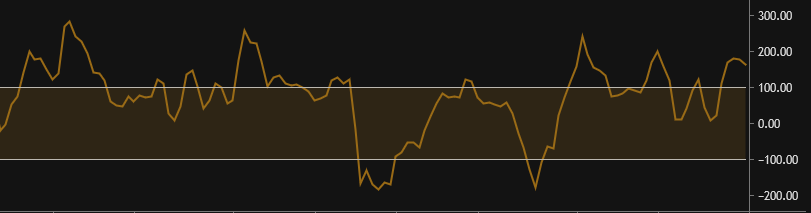

What is the Momentum Indicator and how to use it on Tuned?

In this article, we’ll be talking about the Momentum indicator.We’ll be exploring what it does, its common uses and how it can be applied to Tuned and algorithmic trading in general. Table of contents What is the Momentum Indicator? How is Momentum calculated? Common uses An example strategy using Momentum on Tuned Conclusion What is…

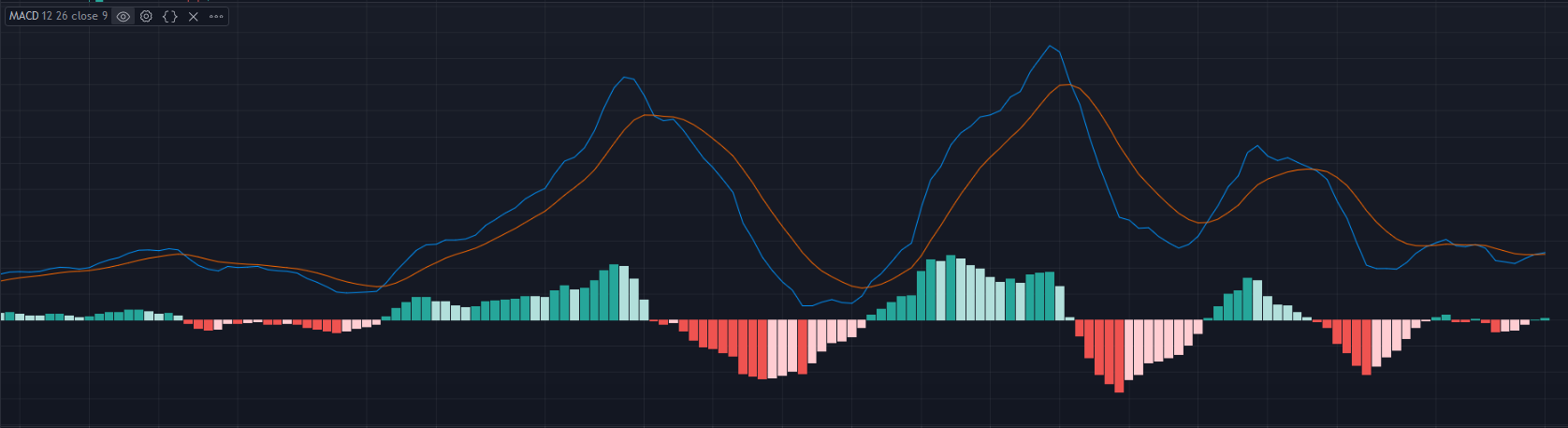

What is MACD and How to Use It in Tuned Script

What Is Moving Average Convergence Divergence (MACD)? Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of an assets price. The MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. The outcome of that calculation is the MACD line. A 9-period EMA of…

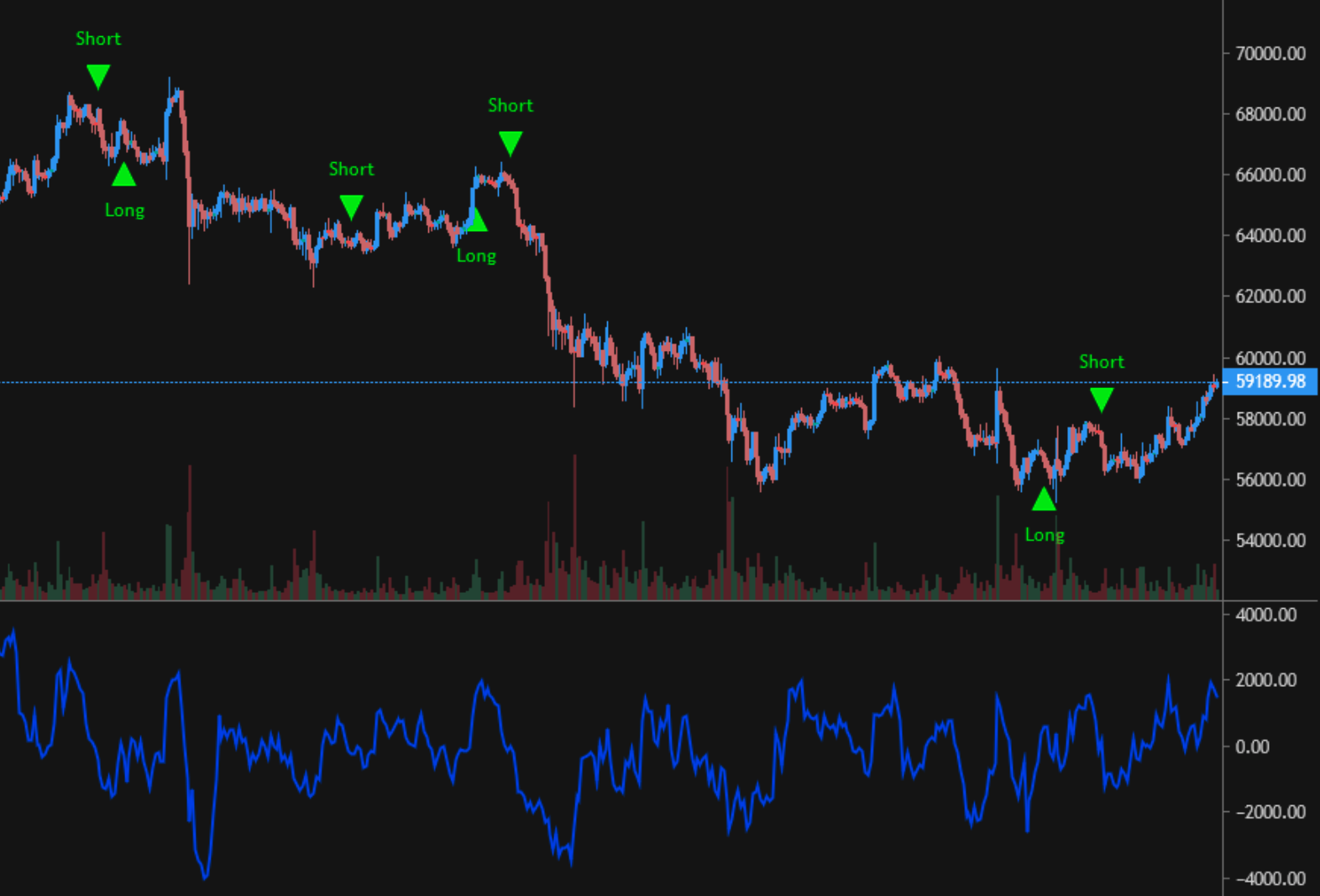

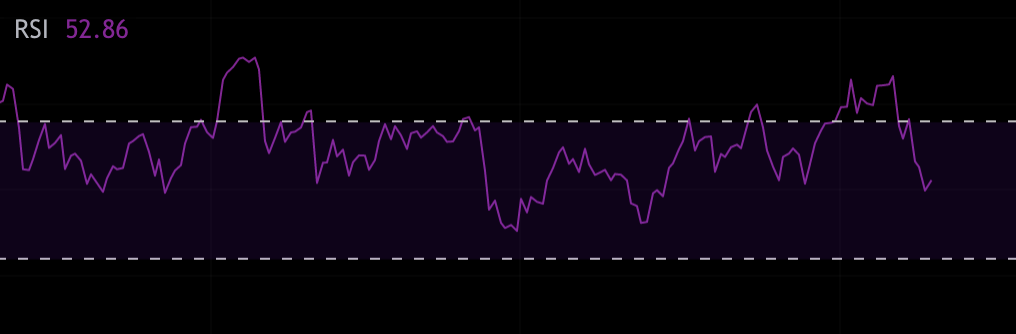

What is RSI and How to Use It in Tuned Script

What Is the Relative Strength Index (RSI)? The relative strength index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator (a line graph that moves…

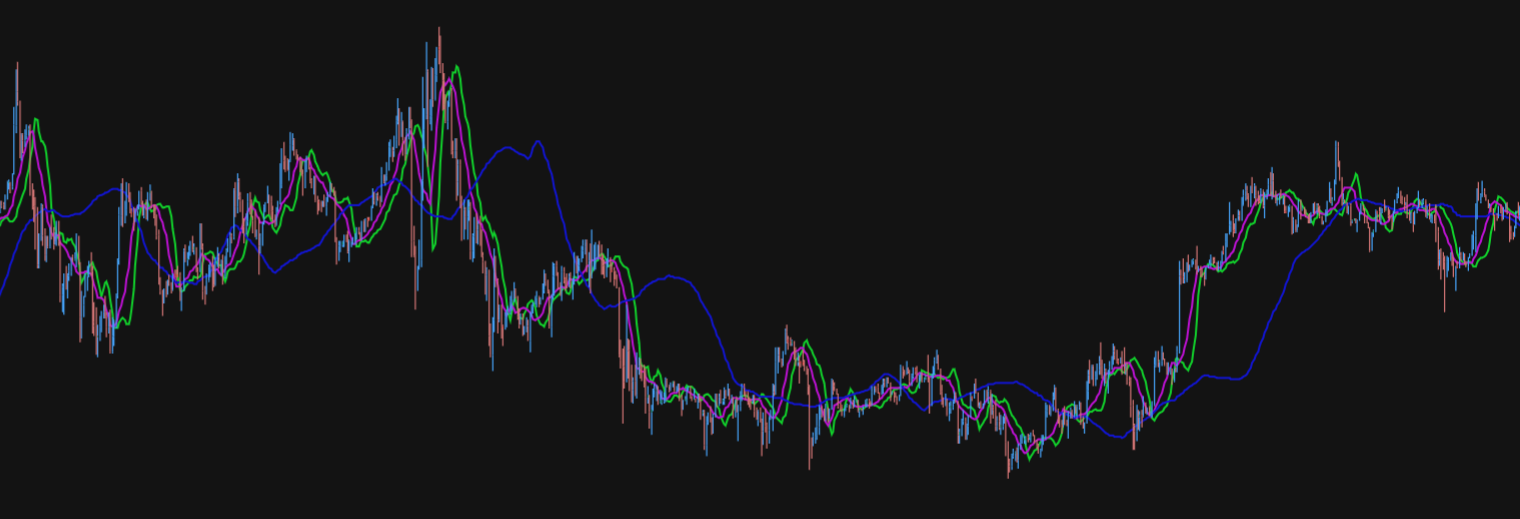

What are Moving Averages and How to Use Them in Tuned Script

What Is a Moving Average (MA)? In statistics, a moving average is a calculation used to analyze data points by creating a series of averages of different subsets of the full data set. In finance/crypto, a moving average (MA) is an indicator that is commonly used in technical analysis. The reason for calculating the moving…