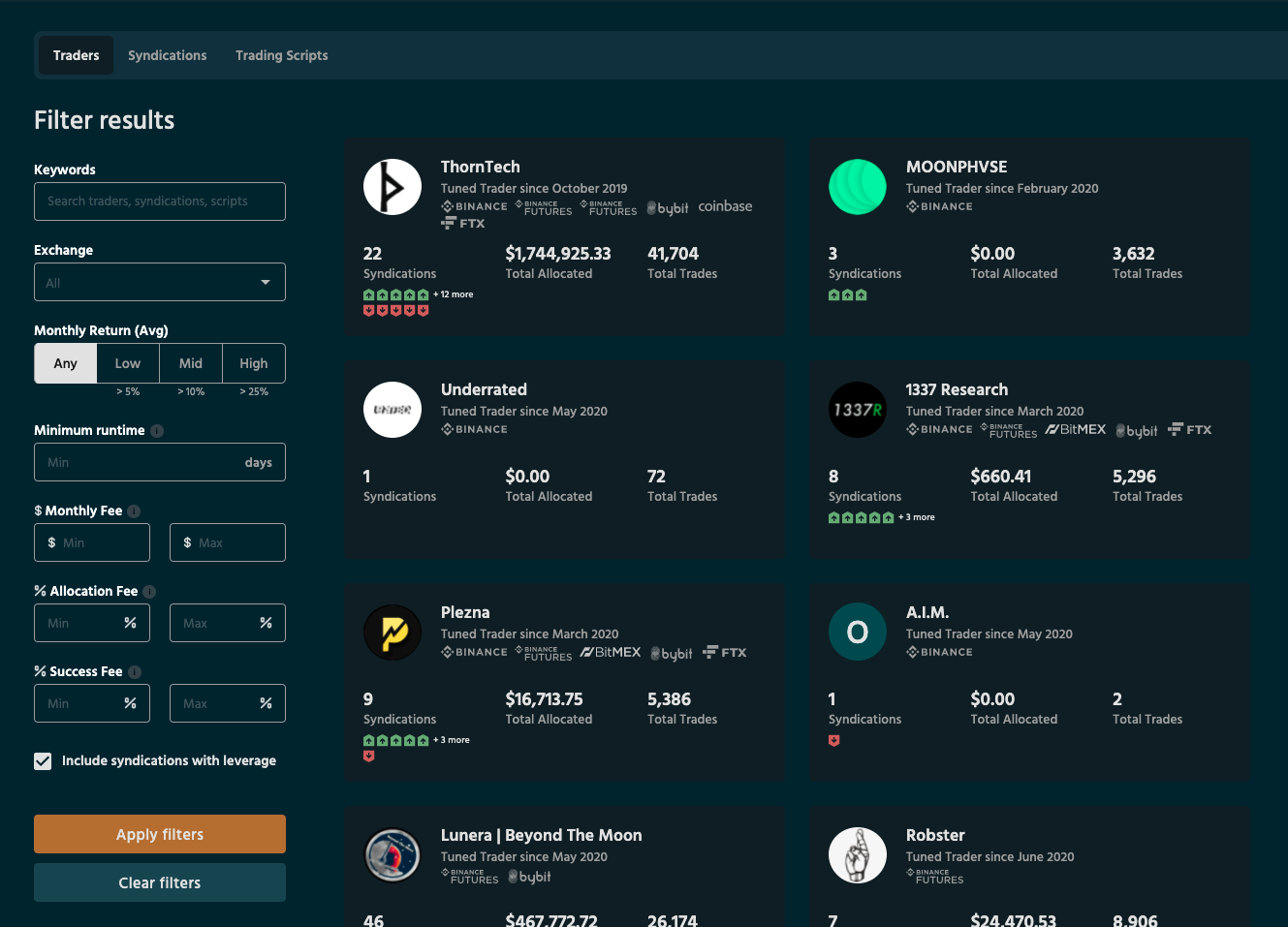

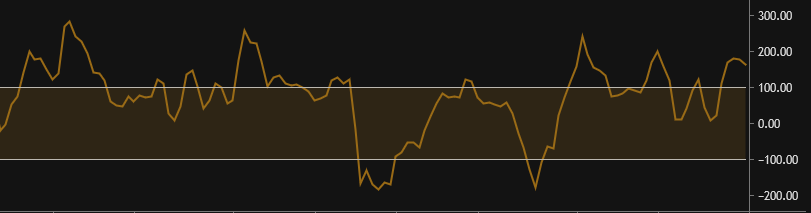

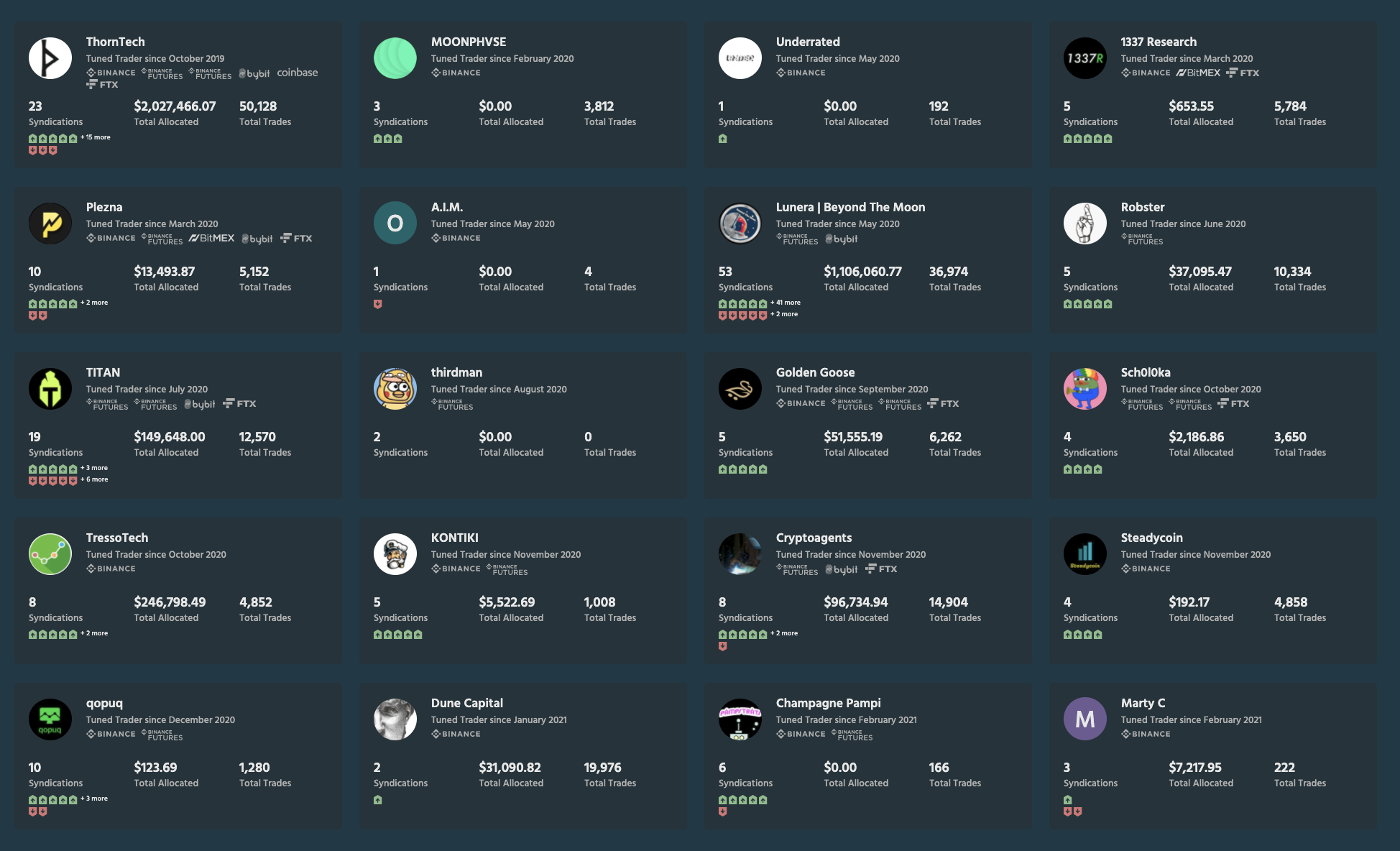

May Performance Update: Tuned syndication sees over 600% profit from volatility in crypto

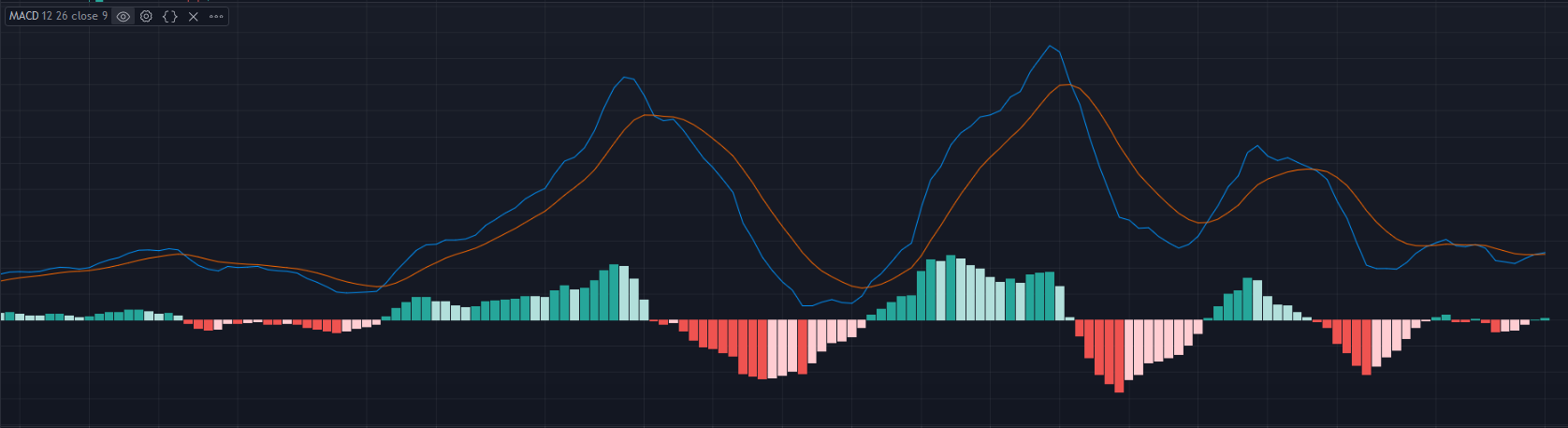

At Tuned, we have a flourishing community and marketplace of strategy creators (quant traders) and investors. All of whom are looking for some kind of financial freedom. The advantage we provide comes from our tools, which are used to create and improve trading strategies. For example, we encourage everyone to vet their ideas with up…