Disclaimer: The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any specific security or investment product. You should never invest money that you cannot afford to lose. Before trading using complex financial products, please ensure to understand the risks involved. Past performance is no guarantee of future results.

With Tuned, traders using Tuned Script or Pine Script Alpha can develop trading strategies, backtest them and run them live on their favorite exchanges.

In this blog post, we’ll give you a quick run down on what strategy creators on Tuned are doing today. With your feedback, we aim to support all quantitative traders, so join our Discord and come build with us.

To unlock profits, try your hand at any of these

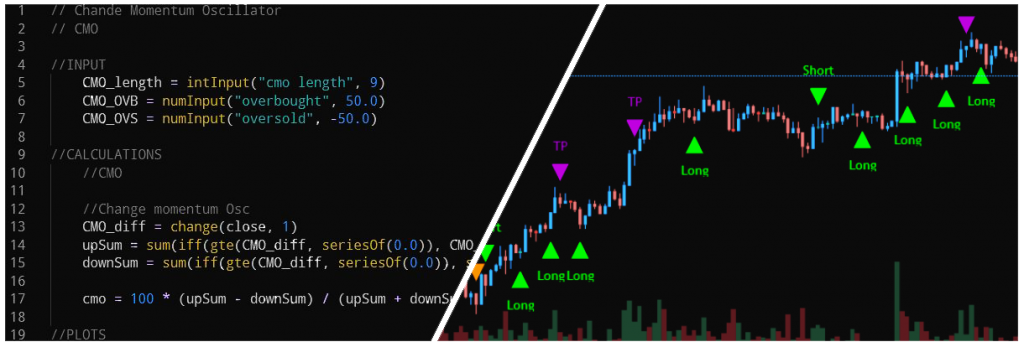

Momentum trading

The most important properties of a momentum trading strategy are the direction and speed of an asset’s price movement. This method of trading usually employs oscillator based technical indicators, like the stochastic oscillator or CCI (commodity channel index).

Trend trading

With greater importance at higher timeframes, trend trading aims to identify the overall direction of an asset’s price. Some common indicators used for this type of trading are RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). Traders generate profits by following a downtrend or uptrend. This strategy isn’t commonly used in low time frames due to the amount of noise that comes from intraday price fluctuations.

Swing trading

Different from momentum trading, swing trading involves positions that can last between a few days or several weeks. There are similarities to trend trading but traders also use classic trading patterns such as head and shoulders, rising/falling wedge, etc. to identify opportunities. Trend technical indicators are often used, along with MAs (Moving averages) and its variants like EMAs (Exponential Moving Averages).

Mean reversion trading

This is one of the first trading methodologies employed by quants, and is based on the notion that after an assets’ price suffers an extreme move, it tends to return to the mean average. Traders identify the mean using a variant of a moving average, like an SMA (simple moving average). One downside of this is its relatively slow reaction time, in comparison to other methods and indicators.

Scalp trading

Also known as arbitrage, traders seek to exploit small inefficiencies in the market. Identifying local supports and resistances helps determine what orders to open. In these cases, the use of leverage is common because asset price movement tends to be small. This is largely due to small timeframes, and requires perhaps the most attention.

It’s possible to automate this method of trading, but not as common. That’s because identifying supports/resistances and order-blocks is mostly driven by intuition, and is hard to specify in an algorithm.

High frequency trading (HFT)

As the name suggests, HFT is a method of trading that involves a large number of small orders placed in a short time frame. This type of trading requires specialized tools to exploit bid-ask spreads. This is almost always reserved for market making trading firms due to the necessary complex software, and large amounts of capital.

You may find that a combination of methods or the addition of volatility indicators, provides greater results. There are likely endless opportunities to derive value from markets, beyond what we’ve noted above. However, these will never be found without a bit of experimentation.

Want to learn more? Here are some resources to help you out: