Category: Strategy Creation

Creating Better Trading Strategies — The Results

Welcome back, data science fans! Continuing from the second article, where I discussed the clustering of buy signals, we’re now ready to get into the meat of things: finding correlated groups. The idea is to find two or more strategies that when combined, give much stronger performance than each would achieve alone. We’ll start with…

Creating Better Trading Strategies — The Process

In our last blog post, I introduced my project to combine buy signals from different strategies to potentially generate higher returns for all traders on Tuned. Today, we’ll be diving deep into the process I took to cluster those buy signals together and exploring some initial findings. Let’s jump right in! In case you missed…

An Intro to Creating Better Trading Strategies

Picture this: the new iPhone 17 Ultra Pro Max just dropped, and you’re debating whether or not to switch up your mobile device. The new holographic display makes the purchase hard to refuse, but the hefty price tag stops you from laying down the cash without a second thought. Now, what if a friend was…

Profit From Volatility With Algo Trading on Tuned

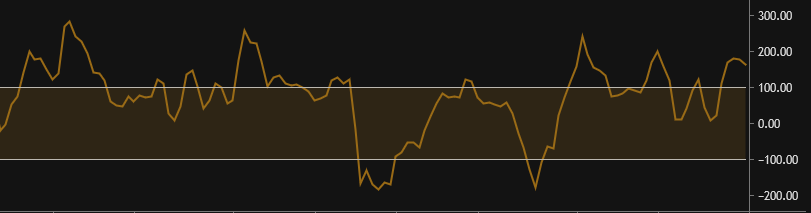

Volatility refers to the amount of price change over a given period of time. The greater the amount and velocity of change, the higher the volatility is. This creates uncertainty for many investors, preventing participation. However, we welcome volatility and see each movement as an opportunity to profit. The first thing to note is that trading…

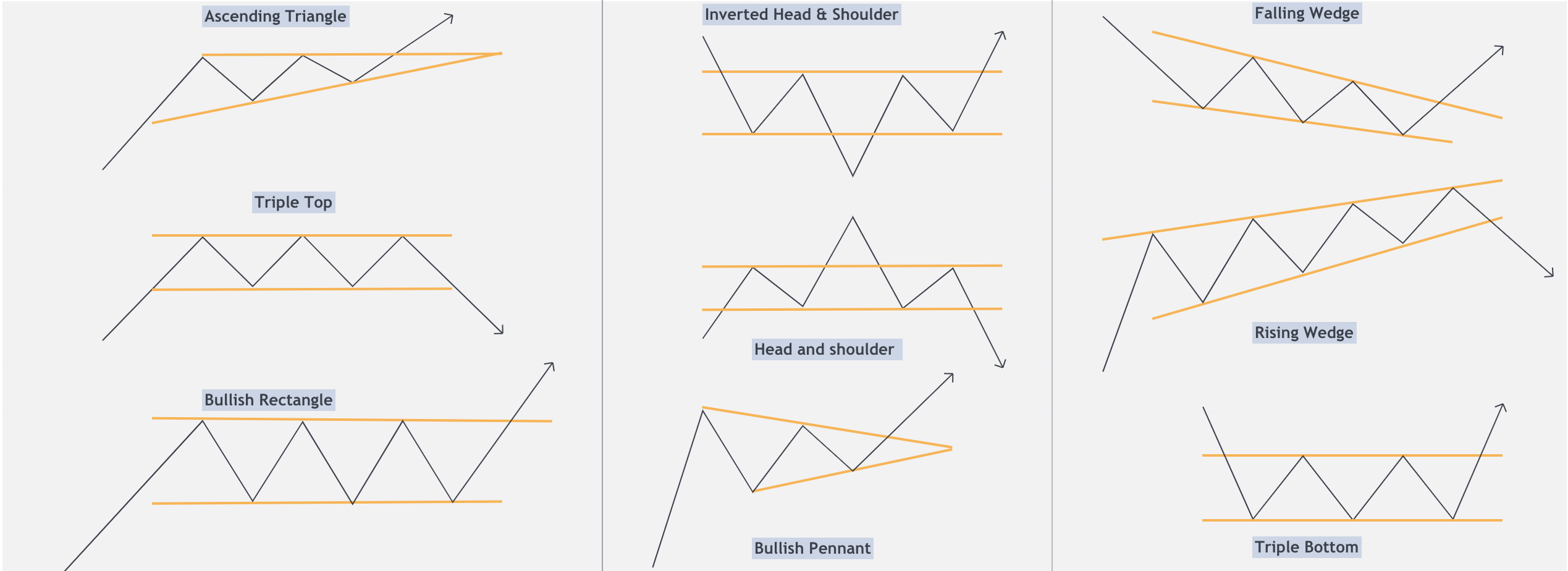

Predict Market Movements With 9 Classic Trading Patterns

Despite automated trading, markets are still largely driven by human participation. Those who pay close attention to the markets will see opportunities for profit using these classical trading patterns. These aren’t written in stone, but should grant a great deal of confidence in predicting the market’s next direction. What’s more, market movements are fractal in…

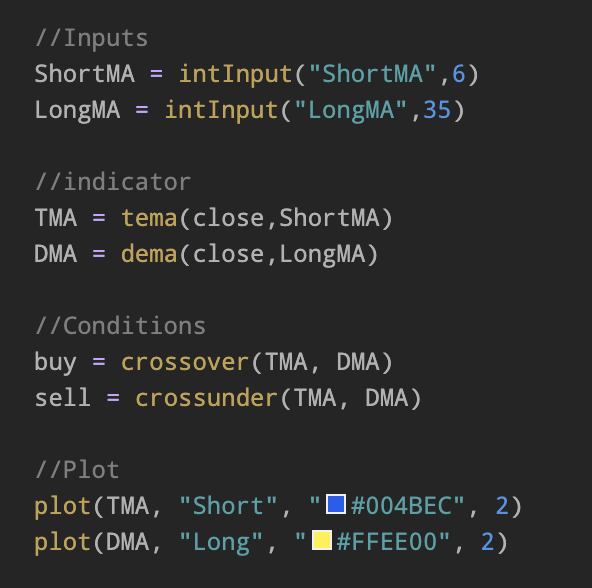

What Is Tuned Script and How Is It Different From Pine Script?

Table of contents: An alternative to Pine Script Data Flow Why two different languages? Example of Pine Script (RSI) Example of Tuned Script (RSI) Executing Orders Plotting – visualize a strategy An alternative to Pine Script Tuned Script is an in-house scripting language developed to write trading strategies. It is powered by Groovy with a…

The Pitfalls of Backtesting – How to Avoid Overfitting and Disappointment

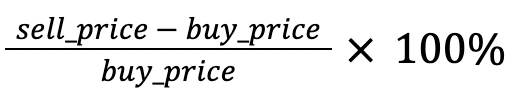

Table of Contents: What is overfitting? How do I avoid overfitting? For the investors reading this article, you can skip ahead to “What is Overfitting?” By this point you may have run a few backtests, on a simple script or using one of our educational scripts. You may have also achieved a very high Profit/Loss…