Category: Strategy Creation

Price Action Series Chapter 4 – Time Frames Confluence

In today’s price action post, we will cover time frames, the importance of confluence between time frames, and candle patterns (covered in chapter 5). There will be a brief study about trading entries and we will share a candle pattern script (in chapter 5). If you miss the other chapters you can follow the link:…

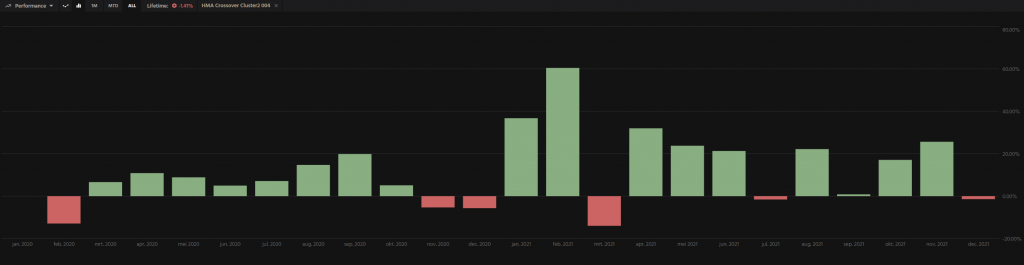

The No-Code Strategy Template by Tuned

Out of 50,000 trading bots there’s a strong chance at least one is profitable. In 2021 Tuned traders tested over 200 million bots, but we noticed an obstacle. Despite free unlimited access, Tuned’s technical nature made it difficult for those unfamiliar. Believing we could do better, we wrote a No-Code Strategy Template that lets you…

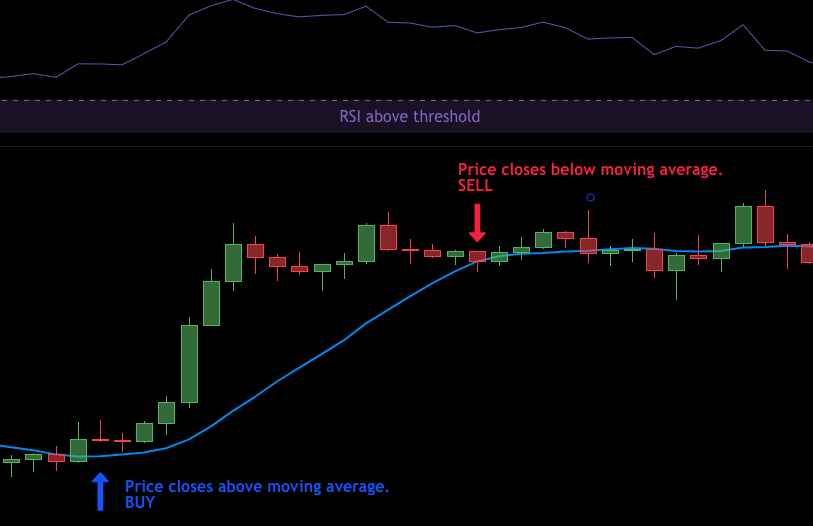

Creating Better Trading Strategies — The Future

And here we have it: the last installment of the data science article series! In our previous article, we created some correlated clusters and came away with some pretty incredible results. To wrap the series up, I’ll be going over how creators can apply these findings and what this research means for the future of…

QFL (Quick Fingers Luc’s) Base Cracker Strategy

This article marks the beginning of a new series on our blog. We’ll dig into a trading strategy developed by QuickFingers Luc and apply it on Tuned. The core of the strategy is trading bounces and cracks. In this article we will explain what bounces and cracks are, how to spot this behavior around resistances…

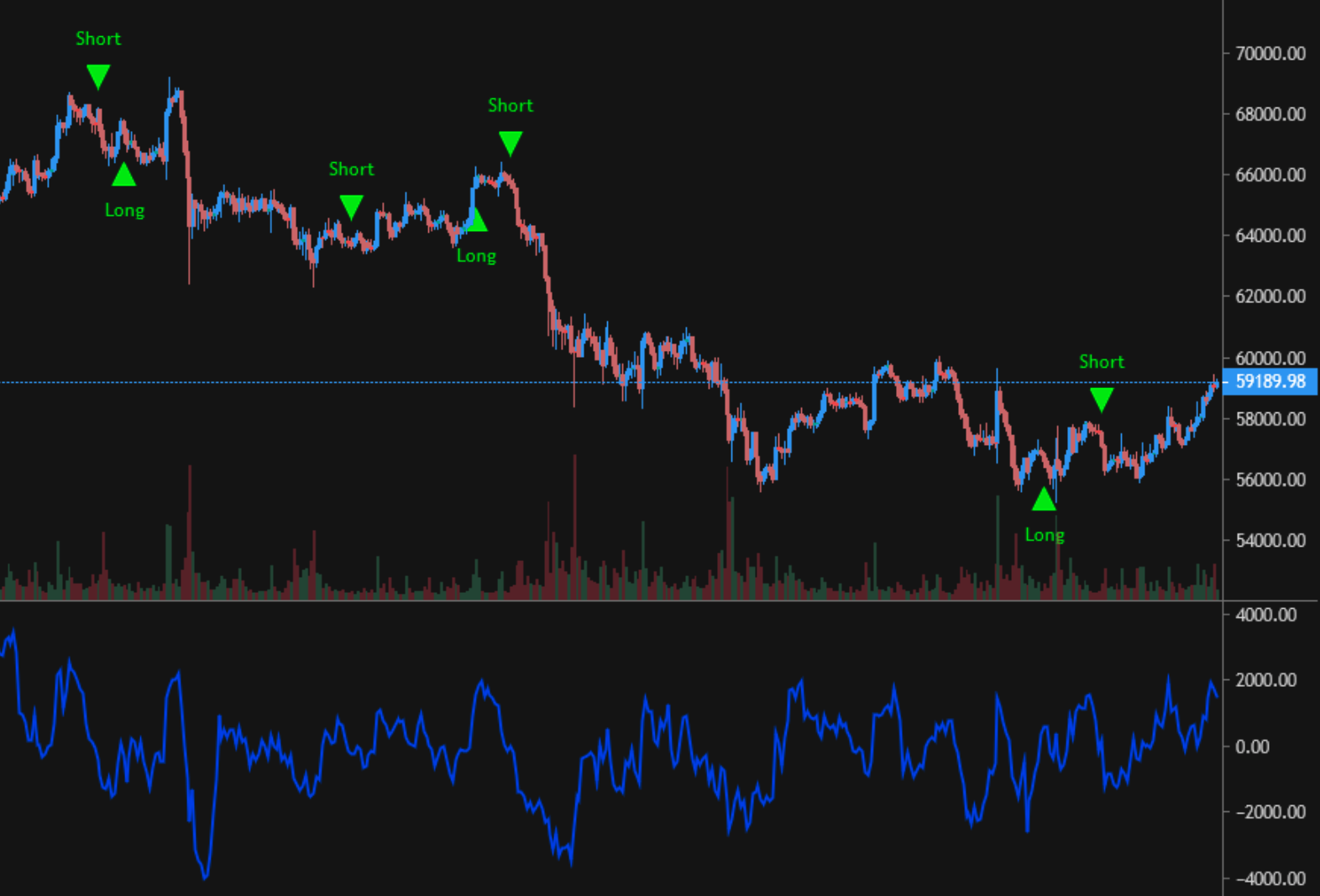

What is the Momentum Indicator and how to use it on Tuned?

In this article, we’ll be talking about the Momentum indicator.We’ll be exploring what it does, its common uses and how it can be applied to Tuned and algorithmic trading in general. Table of contents What is the Momentum Indicator? How is Momentum calculated? Common uses An example strategy using Momentum on Tuned Conclusion What is…

The Number That’s Everywhere, Even Our Markets

Table of contents: What is the Fibonacci sequence? The golden mean in our behavior In practice In May 2021, Dogecoin (DOGE) entered the hall of fame when it topped at 0.74 USDT. This growth also popularized a number of other dog-related cryptocurrencies, ahem Shiba Inu (SHIB). We’re not here to speculate on the next DOGE…